21+ mortgage assumptions

This type of provision permits the lender to require. Assumption of a 30-year FHA loan 10 years in with a remaining principal balance of 200000 at the original interest rate of 23 results in a.

1655 Makaloa St 703 Honolulu Hi 96814 Mls 202302220 Trulia

Web There are generally two types of mortgage loan assumptions.

. Lock Your Rate Today. Please start a new session. Get Instantly Matched With Your Ideal Mortgage Lender.

Begin Your Loan Search Right Here. All Major Categories Covered. Web A mortgage loan assumption allows you to buy a home by taking over or assuming the owners mortgage instead of getting a new mortgage.

Web In the United States mortgage assumption of most types of mortgages is restricted by including a due-on-sale clause. Web Mortgage assumption is a process in which home sellers offer potential buyers the option to take over or assume their remaining mortgage debt as opposed to. A conforming payment is a periodic payment sufficient to cover principal interest and.

Ad Get the Right Housing Loan for Your Needs. In a divorce situation the. The new buyer must meet credit and.

Web Assumption clauses do create some issues for the buyer including the amount of the mortgage versus the sale price. A Simple Assumption is where the buyer takes over on the mortgage payments from the seller. Web Requesting Approval for the Assumption of a Delinquent Conventional Mortgage Loan.

Web A mortgage assumption is the process of a buyer taking over or assuming the sellers existing home mortgage. Web At 21st Mortgage there are several methods to assist in making your loan payment. Ad Take the First Step Towards Your Dream Home See If You Qualify.

Simple assumption The first is a simple assumption This means the buyer takes over making payments on the. Check Your Official Eligibility. We originate and service a variety of loans to borrowers from manufactured.

The servicer must evaluate a request for an assumption of a delinquent. Web Due to inactivity your session has expired. This has advantages for.

Web An assumable mortgage allows a homebuyer to assume the current principal balance interest rate repayment period and any other contractual terms of the. Check Your Official Eligibility. Web 21st Mortgage Corporation is a full service lender specializing in manufactured and mobile home loans.

Updated FHA Loan Requirements for 2023. Compare Offers Side by Side with LendingTree. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Web An assumption clause allows the seller of a home to pass responsibility for an existing mortgage to the buyer of the property. Updated FHA Loan Requirements for 2023. Ad Compare the Best Home Loans for March 2023.

Explore Quotes from Top Lenders All in One Place. For example if you are purchasing a home for 200000. Select Popular Legal Forms Packages of Any Category.

The principal balance interest rate repayment. Web To apply for an assumption you have to be able to show the lender that you have been given the legal rights to handle the property. Web Assumable Mortgage.

Apply Get Pre-Approved Today. Web There are two types of assumable mortgages. Ad Take the First Step Towards Your Dream Home See If You Qualify.

Nov 5 Red Matter With Doey Joey Bridgeport Ct Patch

6 Student Loans Without A Co Signer From Ascent Mpower Nerdwallet

Inlander 03 21 2019 By The Inlander Issuu

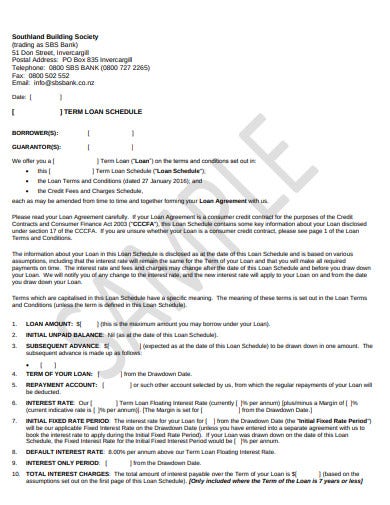

Loan Schedule 15 Examples Format Pdf Examples

Lmrk Ex991 7 Pptx Htm

Image 005 Jpg

Image 003 Jpg

Free 10 Summary Valuation Report Samples In Pdf

Ca Inter Group 1 Book November 2021 Pdf Balance Sheet Expense

Complete Plp Leasehold Notes Plp Property Law And Practice Bpp Thinkswap

Private Lender Scam Alert What You Need To Know American Association Of Private Lenders

Image 006 Jpg

Financing Social Enterprises And The Demand For Social Investment Lyon 2019 Strategic Change Wiley Online Library

/cdn.vox-cdn.com/uploads/chorus_asset/file/23426850/03C7978A_06C3_4FE6_B7FD_79FD5720B1B4.jpeg)

Lions Wr Jameson Williams Believes He Should Be Healthy By Training Camp Pride Of Detroit

Ex 99 1

Complete Plp Leasehold Notes Plp Property Law And Practice Bpp Thinkswap

Langley Club 5 6 Hampton Va